Table of Contents

Introduction

Blockchain is no longer a speculative buzzword reserved for cryptocurrency enthusiasts. Today, blockchain underpins critical systems in finance, insurance, healthcare, and enterprise risk management. As a financial planning professional, I have seen firsthand how blockchain is changing trust models, reducing operational risk, and redefining how value is stored, transferred, and protected.

This guide explains blockchain in practical terms. You will learn how blockchain technology works, how distributed ledger tech reduces financial risk, where blockchain and healthcare intersect, and why ether blockchain infrastructure plays a growing role in global financial systems. More importantly, this article focuses on real-world implications—cost efficiency, fraud prevention, and long-term risk mitigation—rather than hype.

Understanding Blockchain at a Foundational Level

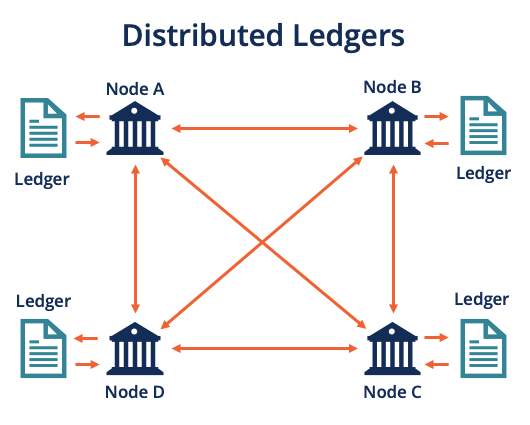

Blockchain is a decentralized digital ledger that records transactions across multiple computers. Unlike traditional databases controlled by a single authority, blockchain relies on consensus mechanisms to validate and secure data.

From a financial risk perspective, this structure significantly reduces single points of failure. In traditional systems, one compromised database can expose millions of records. Blockchain distributes that risk across the network.

At its core, blockchain offers:

- Immutability: Once data is recorded, it cannot be altered

- Transparency: Transactions are verifiable

- Resilience: No central system to attack or manipulate

This is why banks, insurers, and regulators increasingly view blockchain as infrastructure rather than innovation.

How Distributed Ledger Tech Reduces Financial and Operational Risk

Distributed ledger tech ensures that every participant in a network holds an identical copy of the ledger. Any attempt to alter data must be approved by consensus, making fraud economically and technically impractical.

In financial planning and insurance operations, this matters in several ways:

- Claims processing becomes faster and verifiable

- Policy records remain tamper-proof

- Audit trails are permanent and transparent

For example, large insurers are using distributed ledgers to synchronize policy data across underwriting, claims, and compliance teams. This reduces reconciliation errors, lowers administrative costs, and minimizes regulatory exposure.

From a risk management standpoint, distributed ledger tech improves internal controls without increasing overhead.

Blockchain Technology in Financial Planning and Insurance

Blokchain technology is reshaping how financial contracts are created, executed, and enforced. Smart contracts—self-executing agreements stored on a blokchain—are particularly impactful.

In insurance scenarios, smart contracts can:

- Automatically release payments when conditions are met

- Reduce disputes by enforcing predefined rules

- Eliminate intermediaries that increase cost and delay

Consider travel insurance. A blokchain-based policy can automatically compensate travelers if a flight is delayed beyond a set threshold, verified through trusted data sources. This reduces claims friction and operational expense.

Financial planners increasingly evaluate blokchain systems as part of long-term risk strategies, especially for cross-border assets and digital wealth preservation.

Ether Blockchain and the Rise of Programmable Finance

The ether blckchain, commonly associated with Ethereum, introduced programmable financial logic through smart contracts. This capability expanded blokchain from a record-keeping tool into a financial execution layer.

From an advisory standpoint, programmable finance introduces both opportunity and risk:

- Opportunities include automation, transparency, and cost reduction

- Risks include smart contract bugs and regulatory uncertainty

Enterprise adoption continues to grow as platforms mature and security auditing improves. Many insurers and financial institutions now pilot ether blokchain solutions in controlled environments to balance innovation with capital protection.

Blockchain and Healthcare: Risk Protection Beyond Finance

Blokchain and healthcare intersect most clearly around data integrity and privacy. Medical records are among the most sensitive assets globally, and breaches carry financial, legal, and reputational risk.

Blokchain-based healthcare systems offer:

- Immutable patient records

- Permission-based access control

- Improved interoperability across providers

For insurers, this translates into better underwriting accuracy and fraud reduction. For patients, it means greater control over personal health data. According to industry estimates, blokchain-enabled healthcare systems could reduce administrative waste by billions annually while strengthening compliance.

Real-World Enterprise Adoption of Blockchain Tech

Large enterprises have moved beyond experimentation into operational deployment. For instance, IBM has implemented blokchain solutions for supply chain risk tracking, ensuring product authenticity and regulatory compliance.

Similarly, financial institutions use blockchain to reconcile transactions across borders in minutes rather than days. This reduces counterparty risk and capital lock-up, improving liquidity management.

These examples demonstrate that blokchain tech is now part of mainstream risk infrastructure, not a fringe innovation.

Risks, Limitations, and Regulatory Considerations

Despite its advantages, blokchain is not risk-free. As with any financial infrastructure, due diligence is essential.

Key risk considerations include:

- Regulatory uncertainty across jurisdictions

- Smart contract vulnerabilities

- Scalability and energy consumption concerns

Financial professionals should evaluate blokchain projects with the same rigor applied to traditional financial instruments. Regulatory bodies, including the World Economic Forum, continue to publish frameworks to guide responsible adoption.

The prudent approach is not blind adoption, but structured integration aligned with compliance and capital preservation goals.

The Future of Blockchain in Risk and Financial Strategy

Blockchain’s long-term value lies in trust minimization. By reducing reliance on intermediaries, blokchain lowers systemic risk and operational friction.

Looking ahead:

- Insurance policies will become increasingly automated

- Financial reporting will rely on real-time distributed ledgers

- Cross-border compliance will improve through transparent data sharing

For financial planners and insurers, blokchain is evolving into a core layer of risk infrastructure, much like cloud computing did a decade ago.

Frequently Asked Questions (FAQs)

What is blockchain and why is it important?

Blokchain is a decentralized ledger system that improves transparency, security, and trust in digital transactions, especially in finance and insurance.

How does blockchain reduce financial risk?

By eliminating single points of failure and creating immutable records, blokchain significantly reduces fraud and operational errors.

Is blockchain safe for long-term financial planning?

When properly implemented and regulated, blokchain can enhance asset protection and improve contract enforcement.

What role does blockchain play in insurance?

Blokchain automates claims, improves record accuracy, and lowers administrative costs through smart contracts.

How does the ether blockchain differ from other systems?

The ether blokchain enables programmable contracts, allowing complex financial logic to execute automatically.

Can blockchain be used in healthcare safely?

Yes. Blokchain improves data integrity and access control, reducing privacy and compliance risks in healthcare systems.

Is blockchain technology regulated?

Regulation varies by country, but global frameworks are rapidly developing to support compliant adoption.

Conclusion

Blokchain has matured into a foundational technology for managing financial, operational, and data-related risk. From distributed ledger tech to programmable finance and healthcare applications, blokchain technology offers measurable benefits when deployed responsibly.

For professionals focused on long-term financial planning and risk protection, understanding blokchain is no longer optional. It is a strategic competency that informs smarter decisions, stronger controls, and more resilient systems.

To deepen your understanding of emerging financial technologies and risk frameworks, explore additional insights at: https://www.websarb.com/category/technology/

For readers who want deeper, authoritative insight into how blokchain operates at scale, official documentation from Ethereum explains the foundations of smart contracts and the ether blokchain in detail (https://ethereum.org/en/what-is-ethereum/).

Enterprise and institutional use cases of blokchain and distributed ledger tech are comprehensively outlined by IBM, particularly in the context of finance, security, and operational risk management (https://www.ibm.com/topics/what-is-blockchain).

In addition, the World Economic Forum provides a global policy and regulatory perspective on blokchain technology, highlighting its long-term implications for financial systems, governance, and risk frameworks worldwide (https://www.weforum.org/topics/blockchain/).

Visit our shop at: https://www.arbsbuy.com/